Addressing the Conflicts of Continuing Education

We are big fans of healthy competition. As educators, competition motivates us to innovate, differentiate and make quality content as affordable and accessible as possible. And quite frankly, we enjoy working alongside competitors who share our same passion for education.

But unhealthy competition has the opposite effect. It discourages innovation, limits choice, and reduces quality while making education more expensive. Such is the reality for multiple aspects of industry training within Canada’s financial services industry.

One of the more concerning examples of unhealthy competition is with continuing education accreditation for IIROC Registrants.

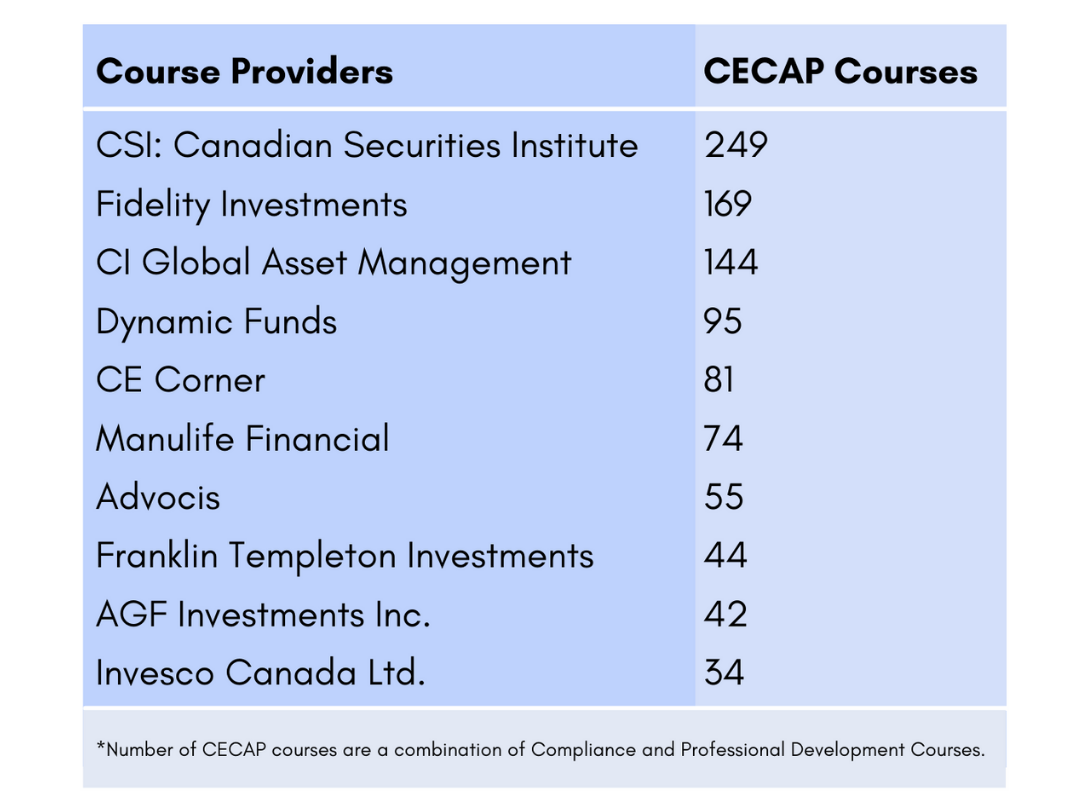

IIROC uses CECAP as its exclusive accreditation service provider, which is owned by Moody’s Analytics Global Education (Canada) Inc., the parent company of CSI Global Education (CSI). CECAP’s exclusivity and ownership model has given CSI an unfair advantage over other course providers, and at the expense of accessible education for advisors.

At $585, CECAP’s cost to accredit a one-hour course is more expensive than any other accreditation body in the industry. Compared to FP Canada’s fee of $70 for the same service, CECAP is 835% more expensive. Not only does CSI’s parent company collect the fees from all other course providers but CSI also avoids paying CECAP’s fees entirely. And therein lies the problem.

By avoiding CECAP’s accreditation fees, CSI has its content accredited in multiple ways: as individual courses, custom course bundles, and specific content within a course. For any other course provider, these layers of accreditation would be cost prohibitive.

CECAP has also been indiscriminately re-accrediting decommissioned CSI courses - discontinued courses that are no longer maintained. We identified several examples, including CSI’s Conflicts of Interest course, which was decommissioned several years ago but is listed by CECAP as an accredited course for IIROC’s most current continuing education cycle, CE Cycle 8.

The CSI/CECAP relationship is a material conflict of interest that has existed for years. And many course providers have expressed frustration about it, how it has impacted their business and the impact to advisor education.

This article is not intended to pick a fight – certainly not with an organization that is bigger and with deeper pockets. But Learnedly has an obligation to do what’s in the best interest of Canada’s financial industry and investors. It is a responsibility we take very seriously. And speaking up is the right thing to do.

But awareness alone is not enough. Accreditation reform and modernization is urgently needed in Canada’s financial services industry. Introducing more continuing education requirements to the industry, including MFDA’s new CE requirements later this year, will be layered on top of an already faulty foundation, which will only compound these problems.

We need the industry’s collective voice to support regulators and modernize professional education. Accreditation is a good place to start.

John Waldron

John originally posted the above in a LinkedIn article.