Protecting Vulnerable Investors: Why it Matters

Protecting vulnerable investors is an important topic that continues to receive more attention and focus from securities regulators. It is a priority for the Investment Industry Regulatory Organization of Canada (IIROC) and will continue to be in 2020:

The Mutual Fund Dealers Association of Canada (MFDA) has identified the protection of aging investors and vulnerable clients as a key theme from its Member Outreach Initiative, and is organizing a Seniors Summit on October 30, 2019:

And earlier this year there have been several other publications released to help protect vulnerable investors, including: Suggested Practices for Engaging with Older or Vulnerable Clients from the Canadian Securities Administrators (CSA):

Why is this important now?

Canada’s population is aging. And although an elderly investor does not automatically mean a vulnerable investor, at some point in our lifetime, our ability to handle complex decisions – including financial decisions – begins to decline.

Exactly when that happens varies with each individual, depending on a range of factors such as genetics, education, family relationships, income level and physical health, but generally speaking, our cognitive abilities start to decline in our late 50’s or early 60’s. And as we move into our 70’s and 80’s, the cognitive decline becomes more pronounced.

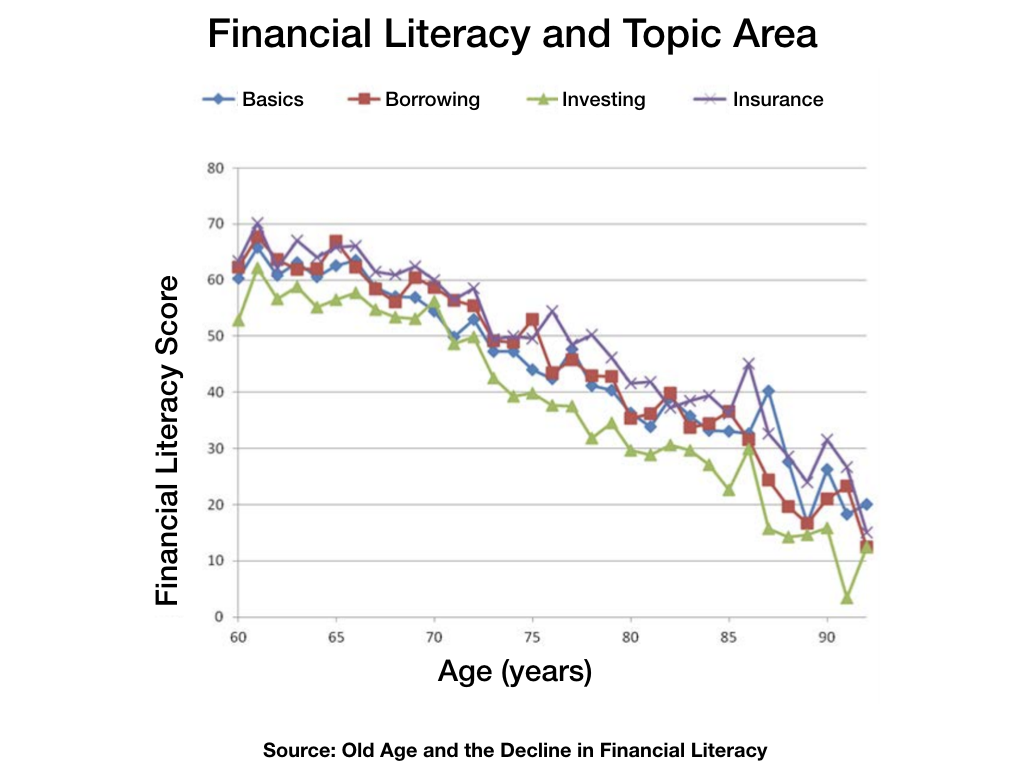

More specific to financial matters, another study tested for financial literacy at different age levels and found that, after age of 60, each year of age is associated with a 1.36 percentage point decline in the total financial literacy score.

More interesting, is that we often fail to recognize our own cognitive decline as we age. The same study showed that overconfidence, relative to financial literacy scores, actually increases with age. In other words, we maintain a high level of confidence in our ability to make right decisions, even as our financial literacy and cognitive abilities decline.

What does this mean for financial advisors working with senior clients?

Financial decisions for elderly investors are critically important, since they do not have the same time horizon or financial means as younger investors, to recover from portfolio losses. Advisors must strike the right balance between managing portfolio risk, investment objectives and client expectations.

At the same time, advisors must also be mindful that, with age comes a decline in our cognitive abilities, even if we don’t recognize it.